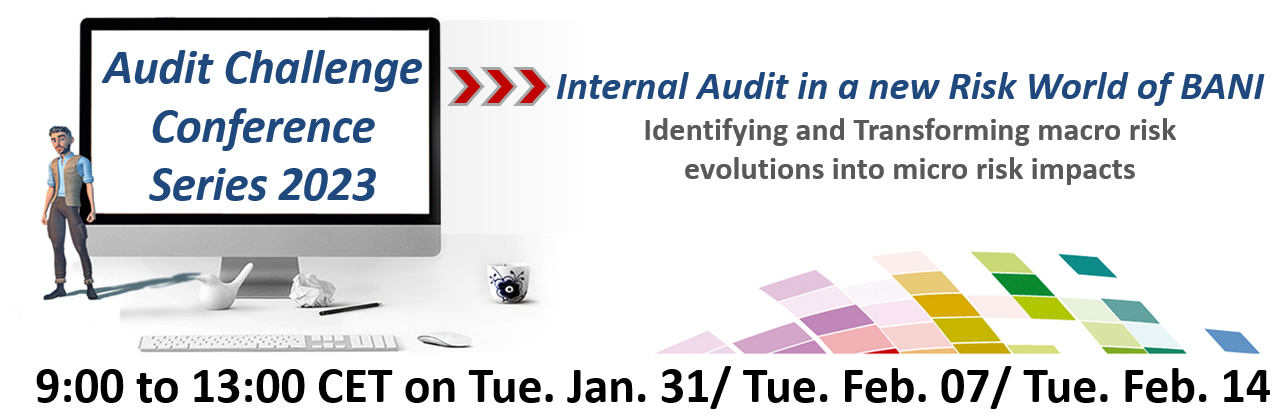

Faster, better and more disruptiv than ever! Audit Challenge Conference Series 2023

25 Top Speakers | 14 CPE | only 195,- € | 18th Anniversary: – Internal Audit in a new Risk World of BANI –

For an overview of the individual conference days and presentations, please click on the table tabs or here on the individual days +++ Go to Registration

1. Audit Challenge | ESG Audit in Spotlight | Tue. 31st January 2023

2. Technological Opportunities in Internal Audit, Performance Transformation in Internal Audit | Tue. 07th February 2023

3. Geopolitical influences change the audit risk landscape | Tue. 14th February 2023

– Internal Audit in a new Risk World of BANI –

Internal Audit Challenge: Identifying and Transforming macro risk evolutions into micro risk impacts

2023 as a virtual conference, participate completely location and end-user medium independent! +++ As of 12th Jan. | Already 198 registrations for the conference +++ Click here for registration +++ See all important information and details under the table tabs.

3 conference days 9:00 -13:00 CET | Audit Challenge Conference Series 18th Anniversary 2023

++ Tue. 31 Jan. 2023 | ++ Tue. 07 Feb. | ++ Tue. 14 Feb. 2023 ++

VUCA has been a successful explanatory concept for nearly 40 years. However, the risk environment has changed significantly. The dynamics of risk events and their degree of impact are different and bigger today. Fitting to today’s risk world, BANI is a new and helpful analytical approach.

We will show you how successful internal auditors deal with this in the BANI world? What are solutions to these current challenges? How can you realign your internal audit team? [Read more below]

Top Speakers at Audit Challenge Conference Series 2023 +++ Click here for registration

++ Andrea Camila Garrido Collazos, President and CEO IIA Colombia

++ Anusha Dasarathi, CIA,CRMA,CFE,FCA, Group Head of Internal Audit, The Sanad Group

++ Tracie Marquardt, Senior Management Trainer, Host of the Live Audit Room Broadcast, Adjunct Member and Partner of Audit Research Center | ARC Institute,

++ Jenitha John, 2022 Internal Audit Beacon Award Winner from Richard Chambers, Past Chairman on the Global Board of Directors of the Institute of Internal Auditors (IIA) and Global Assembly Chairman 2020-2021, Member of GRI Due Process Oversight Committee [Standards for sustainability reporting]

++ Meghna Poojary, SVP Chief Audit and Controls Officer at Mondelēz International

++ Anjana Wijegunasinghe Data & Digital Leader in Audit, Risk and Governance space, DP World Dubai

++ Jenny Tan, Global Internal Audit Leader CapitaLand, Audit Committee Member at Singapore University of Technology and Design and at National Institute of Early Childhood Development

++ Anike Te, Chief Strategy Officer and Group Business Development Board Member of Lucideon Group Ltd, Aegis Professor of Engineering Biology

++ Elena Tejero Hernandez, Head of Internal Audit Ferrovial Spain and other markets

++ Adithya Bhat, Managing Director, Head of Risk at Essar, Former President IIA India

++ Alaba Awolaja, Internal Audit Beacon Award Winner from Richard Chambers, Chief Managing Consultant, GOARISC & Oversight

++ Marc Blasimann, Senior Audit Data Analyst, Swiss Railway Association, SBB

++ Stephen Coates, President Asian IIA Confederation, Partner Anchoram Consulting Australia, Asia Pacific Region

++ Hossam El Shaffei, Founder Oversight Consulting, Member of the Board of Trustees, The Internal Audit Foundation of IIA

++ Ryan Johnson-Hunt, Blockchain and Metaverse Educater, Johnson & Hunt New Zealand

++ David Hill, Chief Executive Officer at SWAP Internal Audit Services, Internal Audit Beacon Award Winner

++ Dr. Rainer Lenz, Chief Audit Executive at SAF-HOLLAND Group, named one of the “Top 10 Internal Audit Thought Leaders of the Decade”, (by Richard Chambers) and Internal Audit Beacon Award Winner of 2020, 2021, and of 2022. Rainer has a teaching assignment at the Johannes-Gutenberg-University in Mainz (Germany)

++ Stefan Preuss, Head of Technology driven Audit Services, Eraneos AG

++ Stefan Raimann, Chief Auditor, Swiss Railway Association, SBB

++ Alexander Ruehle, CEO and Co-Founder zapliance

++ Trent Russel, Founder Greenskies Analytics, Host of the Live Audit Room Broadcast,

++ Stephen Coates, President Asian IIA Confederation, Partner Anchoram Consulting Australia, Asia Pacific Region

++ Bhaskar Subramanian,Chief Internal Auditor – Tata Capital Ltd., Certified Independent Director, former Member of the Audit Advisory Committee of UNOPS, leadership positions with the IIA as President of IIA -India in 2018-19 and as Member of the IIA’s Global Committees (IRC and CREA) from 2014 till 2020

++ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

+++ Click here for registration

Learn how to evolve your audit universe and internal audit risk approaches? Gain Internal Audit know-how at the Audit Challenge Conference on:

- Technological Opportunities in Internal Audit as well as the associated risk trends: On Artificial Intelligence, the new world of work with Augemented Reality, see how the Metaverse is changing our business models, Too Big to Fail scenarios in the cloud industry with Google, Microsoft, Amazon, Apple … and more

- ESG and Climate Change: Bio-engineering, new products and new ESG audit approaches, changes in our business models due to dramatic environmental and climate changes, new governance and strategy understanding.

- Geopolitical shifts as well as behavioral changes among consumers and employees. Geopolitical influences change the audit risk landscape.

For a long time, the VUCA concept successfully served us as an explanatory approach. The VUCA model is now almost 40 years old. However, the risk environment has changed significantly. Suitable for today’s risk world, BANI is a new and helpful analytical approach. This model, based on the concept of James Cascio, helps to better understand current events.

In the past, internal audits often had their focus on internal change processes. These changes were then consequently transported in the audit map into process instabilities and new risk assessments. With the increased popularity of the VUCA impact model, as well as an increase in disruptive events such as financial market instability and new technological changes, more and more external influences have been included in internal audit risk analysis. These external factors have increased dramatically, especially in the last 36 months. They include changes especially in the areas of climate, technology, geopolitics and human behavior. BANI provides a constructive analytical framework for further internal auditing work.

Because today the key challenge is to transfer non-linear cause-effect chains of dynamic external impacts to the company’s own processes and business model. Only in this way is a continuous audit risk assessment of the audit objects in the audit universe possible. This in turn enables a rolling audit planning for a timely adjustment of the respective audit execution.

The first priority here is the early identification and transformation of risk influencing factors and potential events. Suitable macro risk analyses as well as extended thinking models, such as the Johari Window, can help here. Not least made famous by the former US Secretary of Defense Donald Rumsfeld.

Based on this, the core challenge is to correctly link and interpret the potential events depending on a company’s own business model. In this context, macro risk effects and their potential impact on process architecture, products, employee behavior and organizational resilience are analyzed.

With these results, it is possible for Internal Audit to create a risk activity balance sheet of the audit objects. This means that the appropriate risks can always be highlighted and the right audit objects can become the focus of our auditing activities in the sense of today’s agile audit planning.

VUCA Transformation into BANI Audit Risk World +++ Click here for registration

VUCA is a catchy and successful explanatory model to make phenomena like disruption comprehensible. Of course, this also helps internal audit and companies. This makes it easier to explain various risk developments and clarify interdependencies. VUCA as an acronym stands for volatile, uncertain, complex and ambiguous.

The concept of VUCA first appeared in the late 1980s as the US Army War College’s response to the collapse of the Soviet Union. It was only in the further course of the New Economy and the disruptive developments associated with it that the concept was also transferred to the business world. In recent years, the VUCA model has been used intensively in corporate strategy as well as in everyday life as a meaningful and understandable explanatory model. The origin of this is the instabilities that were triggered by the end of the Cold War and the continuing New Economy in the form of digitalisation.

Our companies, internal audit and the business models themselves have adapted to the digital transformation piece by piece. VUCA and digitalisation have thus become part of everyday life. We have acquired new audit skillsets and internal audit toolsets to keep up with the discontinuity and capture complex systems.

However, especially in the last 36 months, risk influences are once again changing significantly. The VUCA explanatory model is no longer sufficient to explain the current challenges for companies and also for society as a whole. BANI continues the original VUCA explanatory model in a new thought model based on the reflections of the author and futurologist Jamais Cascio. The key article is called “Facing the Age of Chaos“.

BANI as a risk explanation model

The acronym BANI consists of the following terms:

++ Brittle ++ Anxious ++ Non-linear ++ Incomprehensible

Many current developments can indeed be described as chaotic. The core problem is that our brain loves patterns and structures. We have also mapped these pattern-recognising processes in our risk systems. However, the geopolitical crises show that irrational behaviour of actors leads to lose-lose situations. People voluntarily shake up a stable construct like democracy with their voting behaviour despite better historical knowledge.

The BANI model explains not only the causes, but also the lasting consequences. Through the BANI perspective, unstable structures become understandable in terms of content and even chaotic environmental conditions can be interpreted in a risk-oriented way. The explanatory model thus helps us to generate a better understanding in order to be able to name current risk developments. In the next step, it is up to us to draw the right conclusions individually for the respective situation, the business model, products or processes.

What is behind the individual BANI sub-dimensions?

B – Brittle:

Brittle is the reaction to and continuation of Volatile of the VUCA model. Due to the high dynamics and the low organisational elasticity of company models and also states, the systems are often not sufficiently resilient and flexible. As a result, the proverbial process stability breaks down. Brittle is exactly the word that describes this state. If something is brittle or friable, it is not elastic. It can only withstand a small amount of stress. The dangerous thing about a brittle system is that it often looks quite stable at first glance. Perhaps the system in question was stable in the past, but the new conditions, such as in a physics experiment at elevated temperature, make it porous and brittle. The decisive moment then usually comes unexpectedly. The risky consequences of such a brittle system are all the more serious because of the surprise effect. The moment of truth is often a critical point of failure that can then no longer be cushioned and can have terrible consequences.

Two mental factors often lead to the result here as side effects:

- Companies and their employees often miss the so-called tipping point. The respective organisational system is often milked for all it’s worth, which in Anglo-Saxon is often referred to as the “Don’t ride a dead horse.” methaphor. The organisation is driven to the limit in spite of breaking points, in order to squeeze out the last part of the possible profit. This then leaves massive signs of attrition on the staff and the machine. Employees leave the company. The competition is overtaking the company.

- Mentally, there is a lack of willingness to deal with the fragile factors. Thus, bit by bit, further predetermined fractures are created by looking the other way, acting unconsciously or consciously ignoring them. The system becomes brittle from within.

Due to the worldwide dependency patterns and networking, the failure of a system can then have a major impact. This results in multiple risk chain effects. There are numerous examples from the past, including the world financial crisis of 2007, the Covid pandemic, the outbreak of war in Ukraine. Therefore, the exciting thing as Internal Audit is to analyse the fragility in the system not only for oneself and one’s company, but also for companies with which networking aspects or impact processes exist.

A – Anxious

Anxiety, fear is the result of uncertainty. The human brain likes neither uncertainty nor disruptive change. This is because both lead to increased energy expenditure in humans, who are natural energy savers. Anxiety, however, leads to the release of neurotransmitters that block the flow of communication between the limbic system and the rational brain, the prefrontal cortex. This puts the brain into fight mode each time through a high release of noradrenaline. This is often called fight-or-flight syndrome. Final conclusion Fear prevents rational thinking and produces human error in potentially manageable situations. Consumers, managers, employees, politicians, voters and other stakeholders make irrational decisions. Depending on the power situation and the crowd, these can then have enormous consequences. Within the framework of game theory, such decisions can be simulated accurately. It is obvious that irrational decisions in fear situations can generate a whole whirlpool of further irrational fear decisions by other actors or players.

In addition, today’s media landscape largely plays on consumers with negative anxiety messages. Depending on the educational situation, these messages can then be sensibly assessed by the respective consumers in relation to existing information or, in the worst case, lead to anxious and irrational counter-behaviour.

N – Non-Linear

Of course, truth has long been multidimensional. However, with an increasingly complex world, cause-effect chains are overlaid and cannot be clearly identified. The automatic espresso machine calls for more water, but the water container is still half full. The PC wants another update, although the last update was only yesterday. The car mechanic says to the customer: I can’t tell you that, I have to connect the maintenance software first and gets his laptop. Simple mechanics allow for simple cause-and-effect chains. These are only a few examples of technology.

However, the more complex the systems in our environment become, the more influencing factors there are that are not immediately recognisable with simple analytics. All too often we assume that A leads to B leads to C. But this is not the case. We cannot derive B only from a cause A, rather sometimes there is a whole construct behind a consequence. And A does not inevitably lead to a single effect B, but can have an infinite number of effects. This leads to the fact that the measures taken may have no recognisable or predictable impact relationship to the result. Large efforts show no effect or small decisions have a massive impact. We then speak of non-linear relationships.

In a non-linear world, we do not see a clear and obvious relationship between cause and effect. The effect may be disproportionate to the cause that produced it, and therefore much larger or smaller than we expected. Similarly, the result of an action may occur with a long delay or not be visible at all. Furthermore, the effect may reinforce the cause that produced it in a circular way, whereby the connections within this process may not be clear and it is impossible to determine a clear beginning and end.

These multidimensional cause-effect relationships can be modelled using “system dynamics” methodology, but often only at great expense and with appropriate training.

I – Incomprehensible

The increase in the segment of ambiguity and multiple meanings in the VUCA model is taken further here in the form of incomprehensibility. More information is no guarantee for a better understanding of the actual facts. More data, even large amounts of data, can also be counterproductive, as they overwhelm our ability to understand the world. They make it difficult to distinguish the noise from the actual signal. Incomprehensibility is actually the end state of “information overload”.

The incomprehensible can be seen as a consequence of a non-linear world. The developer of the BANI concept James Cascio gives an example from software development. In this example, there is a code that does not fulfil an explicit function and would, at least theoretically, be redundant. However, if one removes this code, the programme crashes or cannot be installed anywhere. There is no conclusive explanation.

Comprehensibility leads to orientation and clarity. Orientation and clarity are a key success factor in times of dynamic change. It also reduces the surprise effect. The surprise effect, in turn, makes the subsequent effects seem more intense. Because a crisis that is not completely unforeseeable and does not take us by surprise has a weaker effect on us. We understand it and can prepare ourselves. Comprehensibility therefore ensures that we can at least cognitively take a step towards a solution.

If we don’t understand something, it tends to be overwhelming for us. Incomprehensibility is, among other things, a product of today’s information overload. Transparency, education and fact-checking are the biggest weapons here. Unfortunately, there are a large number of actors who, however, consciously obscure information and overlay it with different actions in order not to have to reveal the actual and necessary information.

Click here and you will be redirected to the booking portal. This will open an internet browser tab with a booking screen.

As a bonus to the 18th Audit Challenge conference, we will provide you with 1 free training license for 5 CPE to our Serious Business Game trainings.

– Internal Audit in a new Risk World of BANI –

Internal Audit Challenge: Identifying and Transforming macro risk evolutions into micro risk impacts

2023 as a virtual conference, participate completely location and end-user medium independent!

3 conference days 9:00 -13:00 CET | Audit Challenge Conference Series 18th Anniversary 2023

++ Tue. 31 Jan. 2023 | ++ Tue. 07 Feb. | ++ Tue. 14 Feb. 2023 ++

– Internal Audit in a new Risk World of BANI –

Internal Audit Challenge: Identifying and Transforming macro risk evolutions into micro risk impacts

Tuesday, 31st January Audit Challenge | ESG Audit in Spotlight +++ Go to Registration

3 Days 9:00 -13:00 CET | Audit Challenge Conference Series 18th Anniversary

1. Audit Challenge | ESG Audit in Spotlight | Tue. 31st January 2023

2. Technological Opportunities in Internal Audit, Performance Transformation in Internal Audit | Tue. 07th February 2023

3. Geopolitical influences change the audit risk landscape | Tue. 14th February 2023

Learn how to evolve your audit universe and internal audit risk approaches? Gain Internal Audit know-how at the Audit Challenge Conference on:

- Technological Opportunities in Internal Audit as well as the associated risk trends: On Artificial Intelligence, the new world of work with Augemented Reality, see how the Metaverse is changing our business models, Too Big to Fail scenarios in the cloud industry with Google, Microsoft, Amazon, Apple … and more

- ESG and Climate Change: Bio-engineering, new products and new ESG audit approaches, changes in our business models due to dramatic environmental and climate changes, new governance and strategy understanding.

- Geopolitical shifts as well as behavioral changes among consumers and employees. Geopolitical influences change the audit risk landscape.

Top Speakers, Presentations and Panel Discussion

++ Andrea Camila Garrido Collazos, President and CEO IIA Colombia

++ Anike Te, Chief Strategy Officer and Group Business Development Board Member of Lucideon Group Ltd, Aegis Professor of Engineering Biology

++ Jenitha John, 2022 Internal Audit Beacon Award Winner from Richard Chambers, Past Chairman on the Global Board of Directors of the Institute of Internal Auditors (IIA) and Global Assembly Chairman 2020-2021, Member of GRI Due Process Oversight Committee [Standards for sustainability reporting]

++ Tracie Marquardt, Senior Management Trainer, Host of the Live Audit Room Broadcast, Adjunct Member and Partner of Audit Research Center | ARC Institute

++ Adithya Bhat, Managing Director, Head of Risk at Essar, Former President IIA India

++ Alaba Awolaja, Internal Audit Beacon Award Winner from Richard Chambers, Chief Managing Consultant, GOARISC & Oversight

++ Stephen Coates, President Asian IIA Confederation, Partner Anchoram Consulting Australia, Asia Pacific Region

++ Dr. Rainer Lenz, Chief Audit Executive at SAF-HOLLAND Group, named one of the “Top 10 Internal Audit Thought Leaders of the Decade”, (by Richard Chambers) and Internal Audit Beacon Award Winner of 2020, 2021, and of 2022. Rainer has a teaching assignment at the Johannes-Gutenberg-University in Mainz (Germany)

++ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

Kick-off 9:00 CET

+ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

++ Presentation topic: A New Audit Risk World VUCA transforms into BANI

+ Anike Te, Chief Strategy Officer and Group Business Development Board Member of Lucideon Group Ltd, Aegis Professor of Engineering Biology

++ Presentation topic: What could Engineering Biology contribute towards Net Zero and long-term sustainability?

+ Tracie Marquardt, Senior Management Trainer, Adjunct Member and Partner of Audit Research Center | ARC Institute,

++ Presentation topic: Communication strategies in a new BANI audit risk world

+ Dr. Rainer Lenz, Chief Audit Executive at SAF-HOLLAND Group, named one of the “Top 10 Internal Audit Thought Leaders of the Decade” by Richard Chambers

++ Presentation topic: ESG | The Future Role of the Internal Audit Function: Assure. Build. Consult.

Presentations: How can ESG Audit be successfully implemented in Internal Audit? Which learning paths do Internal Auditors have to go through?

++ Andrea Camila Garrido Collazos, President and CEO IIA Colombia

++ Jenitha John, 2022 Internal Audit Beacon Award Winner from Richard Chambers, Past Chairman on the Global Board of Directors of the Institute of Internal Auditors (IIA) and Global Assembly Chairman 2020-2021, Member of GRI Due Process Oversight Committee [Standards for sustainability reporting]

++ Adithya Bhat, Managing Director, Head of Risk at Essar, Former President IIA India

++ Alaba Awolaja, Internal Audit Beacon Award Winner from Richard Chambers, Chief Managing Consultant, GOARISC & Oversight

++ Stephen Coates, President Asian IIA Confederation, Partner Anchoram Consulting Australia, Asia Pacific Region

++ Dr. Rainer Lenz, Internal Audit Beacon Award Winner from Richard Chambers, Director Corporate Audit & Advisory Services, SAF-HOLLAND Group

Followed by panel discussion moderated by:

+ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

31st January | Audit Challenge | ESG Audit in Spotlight

“Failure to mitigate climate change” is the Top No. 1 Risk in the new “Global Risks Report 2023” of the World Economic Forum (WEF). The 18th edition of the WEF Global Risks Report reveals the top priority of environmental social governance (ESG) risk.

The majority of all WEF top risks are related to ESG. The dilemma is: There is a high awareness of ESG risks and their impacts among the population and the business community. But the difficult geopolitical situation increases the short-term risk of the rising cost of living and the limited financial resources of the states to effectively combat the ESG risks. This is because people, businesses, and even states are often investing in solutions to reverse current problems now, when there is already an urgent need to break the rising risk curve: military weapons to supply Ukraine or deter geopolitical adversaries, decoupling globalized connectivity and renewing local supply chains and storage capacity for resilience, increased costs in food and energy procurement in private households.

This means the majority of people know the ESG related risks. However, mentally it is difficult to inspire people and companies to invest for risk mitigation measures in a financially strained situation, for ESG relevant risks that have been created by the behavior of generations before and whose investment impact is expected to lead to a positive effect only in the following generations.

Here, again, the BANI approach can help in the explanation. In a linear context, it is simple that for an investment or action, a direct consequence also follows. With this consequence and a clear action, people and companies hope for direct (positive) effects. However, this is not possible in the current initial situation. The exponential risk curves have already developed to such an extent that the (positive) effects only lead to a direct benefit with a long time lag. Since the linear cause-effect chain is not apparent, people find it difficult to exercise investment and renunciation.

At this crossroads of the post-industrial society, the challenge for internal auditing is now to develop suitable audit procedures to evaluate supply chains, establish standards of conduct in a supportive manner, and safeguard overall governance in companies.

In order to ensure the long-term success of a company, it is the responsibility of Internal Audit to contribute added value in the form of appropriate assurance services. Based on the long-term economic and intergenerational risk perspective, the development of a suitable audit service to mitigate ESG risks in the respective company is a Top 1 priority for internal audit departments.

This conference day starts at this interface and provides orientation for internal auditors and audit management on how a suitable integration of an ESG internal audit assurance audit service can be designed.

As an Audit Research Center, we will provide impulses for thinking outside the box in order to show how successful ESG approaches can be implemented in companies.

– Internal Audit in a new Risk World of BANI –

Internal Audit Challenge: Identifying and Transforming macro risk evolutions into micro risk impacts

Tuesday, 07th February: Technology is a game changer | Technological Opportunities in Internal Audit +++ Go to Registration

3 Days 9:00 -13:00 CET | Audit Challenge Conference Series 18th Anniversary

1. Audit Challenge | ESG Audit in Spotlight | Tue. 31st January 2023

2. Technological Opportunities in Internal Audit, Performance Transformation in Internal Audit | Tue. 07th February 2023

3. Geopolitical influences change the audit risk landscape | Tue. 14th February 2023

Learn how to evolve your audit universe and internal audit risk approaches? Gain Internal Audit know-how at the Audit Challenge Conference on:

- Technological Opportunities in Internal Audit as well as the associated risk trends: On Artificial Intelligence, the new world of work with Augemented Reality, see how the Metaverse is changing our business models, Too Big to Fail scenarios in the cloud industry with Google, Microsoft, Amazon, Apple … and more

- ESG and Climate Change: Bio-engineering, new products and new ESG audit approaches, changes in our business models due to dramatic environmental and climate changes, new governance and strategy understanding.

- Geopolitical shifts as well as behavioral changes among consumers and employees. Geopolitical influences change the audit risk landscape.

Top Speakers, Presentations and Panel Discussion

++ Anusha Dasarathi, CIA,CRMA,CFE,FCA, Group Head of Internal Audit, The Sanad Group

++ Meghna Poojary, SVP Chief Audit and Controls Officer at Mondelēz International

++ Anjana Wijegunasinghe Data & Digital Leader in Audit, Risk and Governance space, DP World Dubai

++ Jenny Tan, Global Internal Audit Leader CapitaLand, Audit Committee Member at Singapore University of Technology and Design and at National Institute of Early Childhood Development

++ Elena Tejero Hernandez, Head of Internal Audit Ferrovial Spain and other markets

++ Ryan Johnson-Hunt, Blockchain and Metverse Educater, Johnson & Hunt New Zealand

++ Stefan Preuss, Head of Technology driven Audit Services, Eraneos AG

++ Alexander Ruehle, CEO and Co-Founder zapliance

++ Trent Russel, Founder Greenskies Analytics, Host The Audit Podcast

++ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

Kick-off 9:00 CET

+ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

++ Presentation topic: Technology is a Game Changer | Technological Opportunities in Internal Audit

+ Ryan Johnson-Hunt, Blockchain and Metaverse Educater, Johnson & Hunt New Zealand

++ Presentation topic: The Metaverse and its Impact in 2023 – How to Prepare for the Jobs of Tomorrow

+ Stefan Preuss, Head of Technology driven Audit Services, Eraneos AG

++ Presentation topic: chatGPT | AI driven audits: How Internal Audit (and the company) could deal with it?

+ Trent Russel, Founder Greenskies Analytics, Host The Audit Podcast

++ Presentation topic: Show Me the Data (unless it’s a pie graph)

+ Alexander Ruehle, CEO and Co-Founder zapliance

++ Presentation topic: How AI is transforming the Internal Audit Profession?

+ Elena Tejero Hernandez, Head of Internal Audit Ferrovial Spain and other markets

++ Presentation topic: Audit digitalization at Ferrovial: main initiatives and lessons learned

Presentations: What are the technological capabilities of the internal audit profession? What does a successful technological change process look like?

++ Anusha Dasarathi, CIA,CRMA,CFE,FCA, Group Head of Internal Audit, The Sanad Group

++ Meghna Poojary, SVP Chief Audit and Controls Officer at Mondelēz International

++ Anjana Wijegunasinghe Data & Digital Leader in Audit, Risk and Governance space, DP World Dubai

++ Jenny Tan, Global Internal Audit Leader CapitaLand, Audit Committee Member at Singapore University of Technology and Design and at National Institute of Early Childhood Development

++ Elena Tejero Hernandez, Head of Internal Audit Ferrovial Spain and other markets

++ Alexander Ruehle, CEO and Co-Founder zapliance

Followed by panel discussion moderated by:

+ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

07th February | Technology is a game changer | Technological Opportunities in Internal Audit

The technological transformation of workplaces has taken a new and rapid pace with the pandemic. In this context, an incredible spectrum of new opportunities is opening up for use in the internal audit profession.

The digital communications industry is enabling unprecedented global internet use, online social interaction and financial inclusion. In doing so, looking inside, there are impressive opportunities for internal auditors to collaborate within the audit team, as well as tremendous opportunities to significantly increase the productivity of its own internal audit processes.

In this regard, the internal audit profession must be open to new models of collaboration and audit governance to better address challenges such as remote teamwork, audit data analytics, remote auditing, new audit interaction patterns, and growing infrastructure requirements.

Looking outward, effective Internal Audit Assurance that supports the business can be significant in increasing productivity while companies’ business models are in transition.

The age of data has arrived. It is multiplying at an unprecedented rate, reflecting every aspect of our lives and circulating from satellites in space to phones in our pockets. The data revolution is creating endless opportunities to address the major challenges of the 21st century. Audit data analytics is an important aspect of this, giving internal auditors the ability to audit faster and more comprehensively. The core challenges here are: To be an attractive employer in order to retain highly sought-after specialists with exciting tasks in internal auditing. To create understanding and build competencies among normal business auditors in order to establish clear interfaces in the audit teams. Only then can productivity be increased together. If it is finally possible to bring together motivated and trained audit staff and allocate them to the right audit topics, the remaining challenge for a successful audit conclusion is always: How can we now communicate the valuable results to management in a concise form? That often means how to visualize the excellent audit analysis results?

The technological capabilities are increasing exponentially here as well, especially when we see the latest AI development projects, such as chatGPT. As the volume and reach of data grows, so does our audit assurance ability to analyze and contextualize it. Turning data into true assurance insights requires a strong background in statistics and computer science, as well as subject matter expertise. At the same time, implementing insights requires a careful understanding of the potential ethical consequences – both for individuals, auditors and for entire societies.

The next version of the Internet could be a far more immersive virtual experience. The concept of the “metaverse” has received emerging attention, even though many of its fundamental elements, such as virtual and augmented reality or cryptocurrency transactions, have been under development for decades. By making the Internet a virtual twin of the physical world, this digital transformation could enable new ways of working, buying, learning and socializing. No single company will own or dominate the metaverse, and the race to dominate it has begun.

In doing so, we want to look together at this professional conference, what are the job profiles of tomorrow in the context of the metaverse? and how are companies’ business models transforming? …we work for. This will not only significantly change the risk landscape, but also the work processes to be audited in the future and our audit universe.

As an Audit Research Center, we will provide impulses for thinking outside the box in order to show how a successful technological transformation in internal auditing can be achieved.

– Internal Audit in a new Risk World of BANI –

Internal Audit Challenge: Identifying and Transforming macro risk evolutions into micro risk impacts

Tuesday, 14th February: Geopolitical influences change the audit risk landscape. +++ Go to Registration

3 Days 9:00 -13:00 CET | Audit Challenge Conference Series 18th Anniversary

1. Audit Challenge | ESG Audit in Spotlight | Tue. 31st January 2023

2. Technological Opportunities in Internal Audit, Performance Transformation in Internal Audit | Tue. 07th February 2023

3. Geopolitical influences change the audit risk landscape | Tue. 14th February 2023

Learn how to evolve your audit universe and internal audit risk approaches? Gain Internal Audit know-how at the Audit Challenge Conference on:

- Technological Opportunities in Internal Audit as well as the associated risk trends: On Artificial Intelligence, the new world of work with Augemented Reality, see how the Metaverse is changing our business models, Too Big to Fail scenarios in the cloud industry with Google, Microsoft, Amazon, Apple … and more

- ESG and Climate Change: Bio-engineering, new products and new ESG audit approaches, changes in our business models due to dramatic environmental and climate changes, new governance and strategy understanding.

- Geopolitical shifts as well as behavioral changes among consumers and employees. Geopolitical influences change the audit risk landscape.

Top Speakers, Presentations and Panel Discussion

++ Andrea Camila Garrido Collazos, President and CEO IIA Colombia

++ Dorthe Tolborg, Chief Audit Executive at Danske Bank

++ Marc Blasimann, Senior Audit Data Analyst, Swiss Railway Association, SBB

++ Stephen Coates, President Asian IIA Confederation, Partner Anchoram Consulting Australia, Asia Pacific Region

++ Stefan Raimann, Chief Auditor, Swiss Railway Association, SBB

++ Hossam El Shaffei, Founder Oversight Consulting, Member of the Board of Trustees, The Internal Audit Foundation of IIA

++ David Hill, Chief Executive Officer at SWAP Internal Audit Services, Internal Audit Beacon Award Winner

++ Bhaskar Subramanian,Chief Internal Auditor – Tata Capital Ltd., Certified Independent Director, former Member of the Audit Advisory Committee of UNOPS , leadership positions with the IIA as President of IIA -India in 2018-19 and as Member of the IIA’s Global Committees (IRC and CREA) from 2014 till 2020

++ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

Kick-off 9:00 CET

+ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

++ Identifying and Transforming macro risk evolutions into micro risk impacts

Presentations: How to identify and transform macro risk evolutions into micro risk impacts? A new audit risk landscape

++ Dorthe Tolborg, Chief Audit Executive at Danske Bank

++ Stephen Coates, President Asian IIA Confederation, Partner Anchoram Consulting Australia, Asia Pacific Region

++ Hossam El Shaffei, Founder Oversight Consulting, Member of the Board of Trustees, The Internal Audit Foundation of IIA

++ David Hill, Chief Executive Officer at SWAP Internal Audit Services, Internal Audit Beacon Award Winner

++ Bhaskar Subramanian,Chief Internal Auditor – Tata Capital Ltd., Certified Independent Director, former Member of the Audit Advisory Committee of UNOPS , leadership positions with the IIA as President of IIA -India in 2018-19 and as Member of the IIA’s Global Committees (IRC and CREA) from 2014 till 2020

Followed by panel discussion moderated by:

+ Dr. Dominik Foerschler, Managing Director, Chairman of the Digital Transformation Board, Audit Research Center | ARC Institute

14th February | Geopolitical influences change the audit risk landscape

Concerns about the supply of energy, food and core technological elements are prompting more and more countries and companies to take risk mitigation measures. In this context, Internal Audit can contribute significant added value with focused audits.

In the area of short- and medium-term Top 10 risks in the WEF’s new Global Risk Report 2023, geo-economic risk or geo-economic confrontation is the greatest threat in terms of a cause-and-effect chain. The World Economic Forum’s 18th edition, in fact, analyzes that geopolitical fragmentation will drive geo-economic warfare and increase the risk of multi-domain conflicts.

Starting with audit data analytics based on supply data, risk maps can be created to analyze supply chain flows in different geopolitical dependency patterns. This and other starting points provide an opportunity to reconfigure the internal audit risk map. In the past, internal auditors often focused only on net risks within the company. Therefore, it is necessary today and in the future to broaden the view with a well-structured gross risk analysis. This gross risk analysis provides the opportunity to better incorporate macro risk influences. These influences can be classified according to the classical approach into political, economic, socio-demographic, technological, legal and ecological influences.

This makes it possible to transform the respective macro risks influences into audit-specific micro risk impacts related to individual audit objects. Based on this, risk mitigating actions can then be assessed for their quality and resilience in the next step.

In this way, Internal Audit is able to analyze important macroeconomic risk situations in advance with a holistic risk analysis and to convert them into appropriate audit actions as quickly as possible within the framework of a continuous risk assessment process. This enables the right priorities to be set in audit planning and in the allocation of internal audit resources in a forward-looking manner.

In this context, it is important for internal auditors to take into account that concerns about energy security, especially with regard to oil and natural gas, have led to decades of geopolitical conflict. This stems from anxiety over access to upstream resources and participation in (or exclusion from) energy transit infrastructure projects. Russia’s invasion of Ukraine has once again brought home to us the risks of energy import dependence and the extent to which fossil fuels can become weapons. In this context, geopolitical dependence and, as a consequence, the risks for companies and their business models can certainly be described as an “unknown-known” risk. After all, numerous macroeconomic think tanks have warned loudly about this danger. However, the numerous weak signals on the risk map, as well as stronger ones later on, were misinterpreted. In the globalized network, most companies as well as states trusted in the paradigm that common or mutual economic dependencies in the form of win-win situations could prevent a war and such a confrontation.

Another important issue is food security. The rise in food prices in 2007 and 2008, as well as in 2011 and 2012, has shaken the international system and contributed to instability in the Middle East and North Africa. Russia’s aggression in Ukraine currently triggered rising grain prices, given the importance of both countries in the international market, and created new risks to international stability.

The unbalanced global distribution of rare earths, essential for microelectronics, telecommunications and battery technology, is also a concern for governments. In parallel, the technology race among major powers has highlighted the importance and geographic location of the world’s largest semiconductor producers, as well as issues of data localization and sovereignty.

The COVID-19 pandemic has revealed a severe lack of domestic manufacturing capacity in many countries, even for relatively simple products. And a decades-long trend toward longer and more international supply chains, driven by the search for cost efficiencies in an expanding global marketplace, has led to a seriously dangerous pattern of thinking or cognitive bias about the threat environment.

Partial disengagement in favor of shorter, simpler supply chains with less reliance on states involved in conflict or affected by sanctions are new economic and political priorities – as are building expanded domestic industrial capacity and relocating critical production to increase resilience to supply disruptions.

This trend does not mean that the investments made in recent decades will be completely reversed (or lost). Relations between most countries in the international system remain cooperative and based on mutually beneficial exchanges. However, the range of industries and commodities that countries consider strategic has expanded and become the heart of new resilience efforts. In addition, the number of bilateral relationships between states subject to security-oriented constraints has increased and could expand further if major conflicts occur.

As an Audit Research Center, we will provide impulses for thinking outside the box in order to show what possibilities Internal Audit has to identify and transform macro risk evolutions into micro risk impacts on the audit universe.